- The Crypto Fire

- Posts

- ⚡ Bitcoin 101: How the First Digital Currency Changed Money Forever

⚡ Bitcoin 101: How the First Digital Currency Changed Money Forever

Discover how bitcoin works, why it’s limited to 21 million, and what makes it the most trusted crypto on earth.

Table of Contents

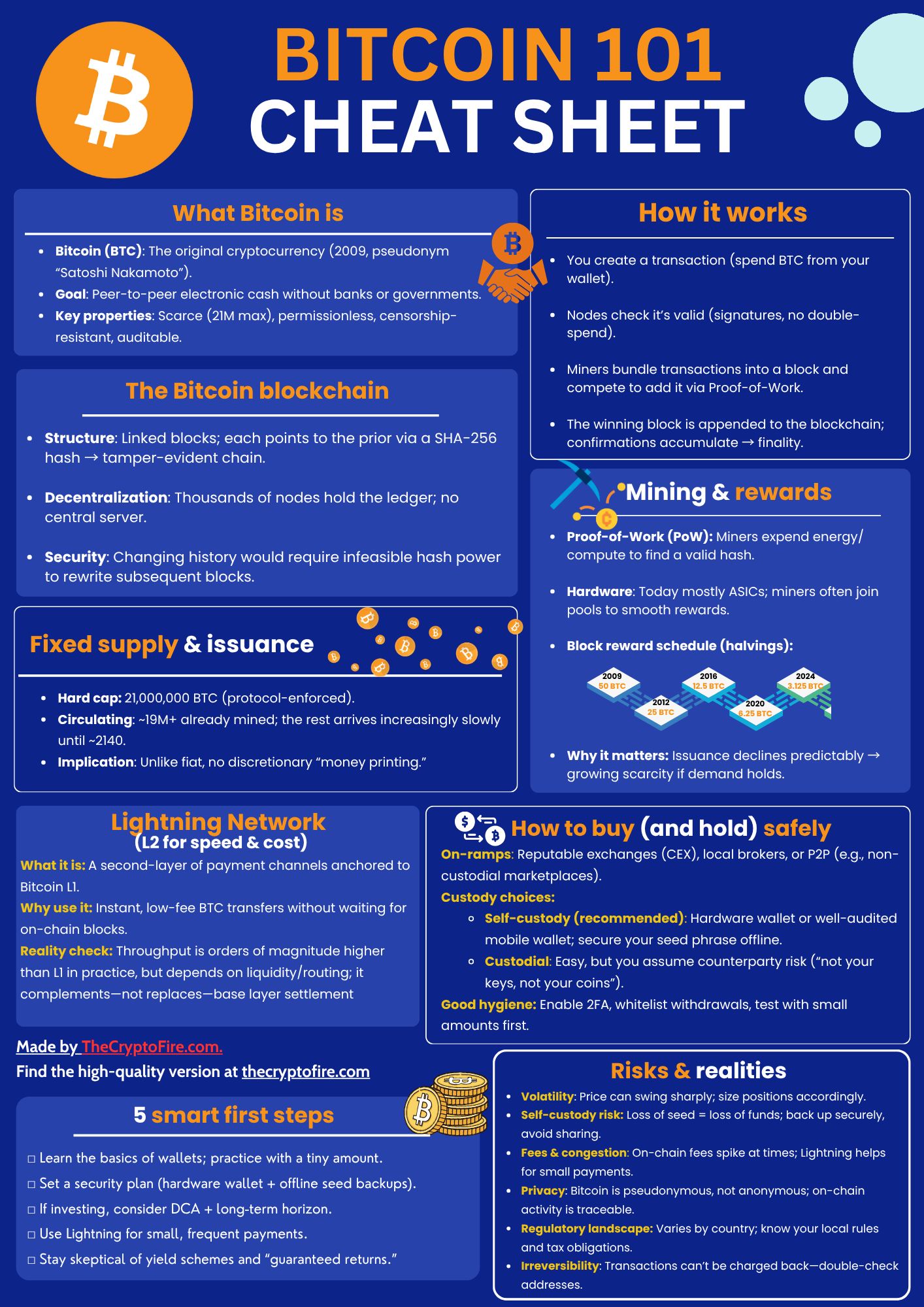

Before we dive in, grab this one-page Bitcoin 101 Cheat Sheet—a quick, printable snapshot you can keep open while you read.

What is Bitcoin?

What is Bitcoin?

Bitcoin ($BTC.X ( ▼ 0.89% ) ) is the first and most well-known digital currency, a form of digital money that operates outside the control of any government or financial institution. It was created in 2008 by an anonymous person or group under the name Satoshi Nakamoto. The main aim was to develop a decentralized, peer-to-peer electronic cash system, free from the influence of centralized authorities such as banks.

For crypto for beginners, think of Bitcoin as internet-native money with rules encoded in software, not set by a central gatekeeper. Bitcoin popularized the blockchain: a distributed ledger that records every transaction. That transparency and neutrality are what make this digital currency hard to censor and easy to verify.

How Bitcoin Works?

How Bitcoin Works?

In essence, Bitcoin is a digital currency used for transferring value, just like traditional money. However, the key difference is that Bitcoin does not rely on banks or any other centralized entities. Instead, it uses cryptographic techniques and a decentralized network of computers (known as nodes) to verify and record transactions on a public ledger called the blockchain.

If you’re exploring crypto for beginners, picture a shared spreadsheet that anyone can audit, where entries are locked in by math. No single party can quietly rewrite it after the fact.

What Is Bitcoin Blockchain?

What Is Bitcoin Blockchain?

Bitcoin’s blockchain is a distributed database that records all Bitcoin transactions. It is maintained by a network of computers spread across the globe. Each "block" in the blockchain contains a list of transactions, and once added to the blockchain, the block cannot be altered or deleted.

The blockchain works through cryptographic hashing. Every time a block is added to the blockchain, it is linked to the previous block, forming a chain of blocks. This makes it incredibly difficult to tamper with, providing high security for Bitcoin transactions.

Blocks are chained with cryptographic hashes. The network uses SHA-256 to convert data into a 256-bit fingerprint. Tampering with one block would require changing every block after it—while outpacing thousands of nodes checking your work. That security model is why this digital currency can function without a central authority—and why crypto for beginners often start here to understand the basics.

Mining Bitcoin

Mining Bitcoin

Bitcoin mining is the process of verifying transactions and adding them to the blockchain. Miners use powerful computers to solve complex mathematical problems, and the first miner to solve the problem gets to add the new block to the blockchain. In return, they are rewarded with newly minted bitcoins. This process is resource-intensive and requires a lot of energy.

Originally, it was possible to mine Bitcoin using regular home computers. However, as the Bitcoin network grew, mining became more competitive, and specialized hardware called ASICs (Application-Specific Integrated Circuits) became necessary. These machines are specifically designed to mine Bitcoin and are much faster than regular computers.

Bitcoin miners also compete with each other in what is known as "mining pools," where resources are combined to increase the chances of successfully mining a block. Miners in these pools share the rewards, but the payouts are generally smaller than if a miner were mining solo.

The reward that miners earn halves roughly every four years by design. It began at 50 BTC per block in 2009; it fell to 25, then 12.5, then 6.25—and on April 20, 2024 at block 840,000 it dropped again to 3.125 BTC. Over time, issuance tapers toward a hard cap of 21 million—a cornerstone of Bitcoin as scarce digital currency.

After that, miners rely increasingly on transaction fees.

Bitcoin’s Fixed Supply and Halving

Bitcoin’s Fixed Supply and Halving

A key feature of Bitcoin is its fixed supply. There will only ever be 21 million BTC in existence. That programmed scarcity protects this digital currency from arbitrary inflation, unlike traditional fiat currencies that can be printed at will by governments. As of now, around 19 million BTC have been mined, the rest will be issued over decades.

The halving cuts miners’ new-coin rewards by 50% about every four years. With fewer coins entering circulation, supply pressure often meets demand — and historically that dynamic has shaped longer-term cycles. For crypto for beginners, the takeaway is simple: rules > rulers.

Bitcoin’s Role as a Store of Value

Bitcoin’s Role as a Store of Value

Bitcoin started as “internet cash.” Over time, many treat it as a store of value—money you hold for the long haul because its rules don’t bend. That doesn’t make it stable day-to-day; it’s volatile. Over years, the scarcity and portability make a case for holding some digital currency alongside traditional

In January 2024, U.S. regulators approved the first spot bitcoin exchange-traded products, pulling BTC exposure into ordinary brokerage accounts. For crypto for beginners, that made it easier to gain regulated exposure without managing wallets on day one.

The Lightning Network: Scaling Bitcoin

The Lightning Network: Scaling Bitcoin

But isn’t Bitcoin slow?

On the base layer, Bitcoin processes a handful of transactions per second. Blocks arrive roughly every ten minutes and carry limited space. That design is conservative on purpose; it keeps verification cheap enough that many people can run nodes.

To address this limitation, the Lightning Network was developed as a "second layer" solution where people settle rapidly off-chain and anchor back to the main chain later. That lets this digital currency feel instant and nearly free at the checkout counter while the base layer stays conservative.

The Lightning Network allows for faster and cheaper transactions, making Bitcoin more suitable for small, everyday purchases. It has the potential to scale Bitcoin’s transaction capacity, handling up to one million transactions per second.

If you’re following along as crypto for beginners, think of Lightning as express lanes built above a sturdy highway. This system makes Bitcoin more practical for microtransactions and is helping to drive the adoption of Bitcoin as a method of payment. The Lightning Network is also helping to alleviate some of the high transaction fees that Bitcoin users face when the network is congested.

How to Buy Bitcoin?

How to Buy Bitcoin?

If you’re interested in buying Bitcoin, there are several ways to do so. The most common method is to use a cryptocurrency exchange, such as Coinbase or Binance. These platforms allow you to buy Bitcoin using traditional fiat currencies like the US dollar. You can purchase Bitcoin in fractions, so you don't need to buy a whole Bitcoin, which can be very expensive.

Once you’ve bought Bitcoin, you can store it in a digital wallet, which allows you to send, receive, and store your Bitcoin securely. A wallet is essentially a software application that holds the private keys to your digital currency. There are various types of wallets available, including online, desktop, and hardware wallets, each with its own level of security.

For crypto for beginners, start with a reputable software wallet, practice small sends, and graduate to a hardware wallet when the amount matters.

Using Bitcoin

Bitcoin can be used for a variety of purposes. It is accepted by many merchants and online stores as a form of payment, and some physical stores also accept it. To make a payment, you simply need to scan the store’s QR code with your Bitcoin wallet app and approve the transaction.

Bitcoin’s growing popularity has also led to the rise of investment products like Bitcoin ETFs and Bitcoin futures, allowing investors to gain exposure to Bitcoin without directly buying and holding the cryptocurrency. Many people see Bitcoin as a way to diversify their investment portfolios, while others buy this digital currency simply for speculation.

Risks of Using and Investing in Bitcoin

Risks of Using and Investing in Bitcoin

While Bitcoin offers many benefits, it also comes with significant risks. One of the main risks is its price volatility. The price of the digital currency can fluctuate dramatically in a short period, making it a risky asset for investors. Additionally, Bitcoin transactions are irreversible, so if you make a mistake or fall victim to a scam, there’s no way to recover your funds.

Regulations vary by country and can change; keep an eye on tax and reporting rules that apply to your digital currency holdings. Some governments have banned or heavily regulated Bitcoin, while others are still figuring out how to approach it. It's important to be aware of the legal implications of using and investing in Bitcoin in your country.

The common beginner mistake is rushing. The better move, especially for crypto for beginners, is to learn with tiny amounts and clear habits.

Why Bitcoin still matters?

If your local bank works perfectly and your currency is stable, Bitcoin can look like a curiosity. In places where accounts freeze, inflation bites, or cross-border wires stall, a neutral, open monetary network is not a thought experiment. The point isn’t to abolish banks; it’s to have a choice—to hold an asset whose rules are transparent, to move value at any hour, and to verify instead of asking permission.

For crypto for beginners, the best way to learn is to try a tiny amount, send it, receive it, and watch how this digital currency behaves when no one can flip a central switch.

For now…

Don’t forget to follow us on TheCryptoFire Telegram Community to get your latest news about crypto world and what’s trending right now!

What did you think of today’s post in Crypto Foundations series? |

Reply